The economic downturn in the recent past hit many small and medium sized businesses very hard. Some have been able to hang on, but only because their creditors have been willing to work with them. Things are starting to turn around, but perhaps not quickly enough to satisfy creditors. If your creditors are getting impatient […]

Payroll Taxes are Not a Short Term Loan From the IRS

A client came to see me because the IRS was threatening to shut down his business for non-payment of payroll taxes of over $100,000. I asked why the taxes hadn’t been paid and he told me that he had cash flow problems so he used the payroll taxes as a short term, low interest loan […]

Can My Claim Survive Bankruptcy?

One of the key reasons a debtor files bankruptcy is to obtain a discharge of the debtor’s pre-petition debts. Generally, only an individual debtor obtains a discharge. In cases of corporate reorganizations, the Plan may include a provision that except as provided in the plan all pre-petition obligations are discharged, but otherwise, the corporation does […]

Can Debtor Avoid Turning Over Assets to the Bankruptcy Trustee?

Let’s say “Jane” doesn’t see a lawyer in time to orderly dissolve the company, and now Big Bank and a few other creditors are coming after her. She hasn’t found a new full time job, and she’s coming to the end of her savings. Pretty soon she won’t be able to pay her credit card […]

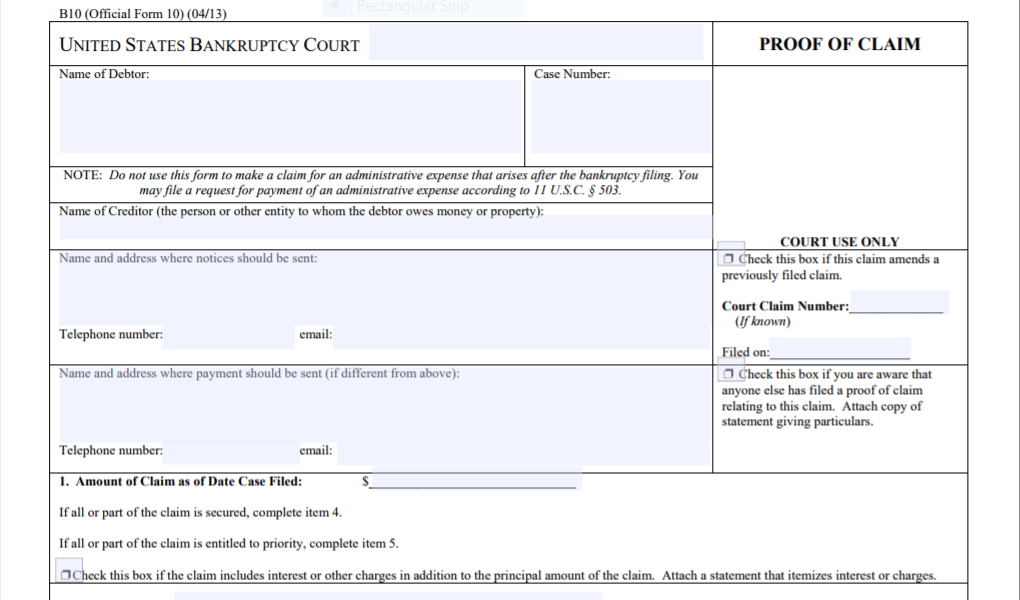

Creditors Don’t Forget to File Your Proofs of Claim When a Debtor Files for Bankruptcy

One of the first things you as a creditor should do when you receive notice that a customer has filed bankruptcy is to file a proof of claim. The Proof of Claim form (Official Form 10) often accompanies the notice of the commencement of the case, and can also be found at the Court’s website. […]

- « Previous Page

- 1

- …

- 4

- 5

- 6

- 7

- Next Page »