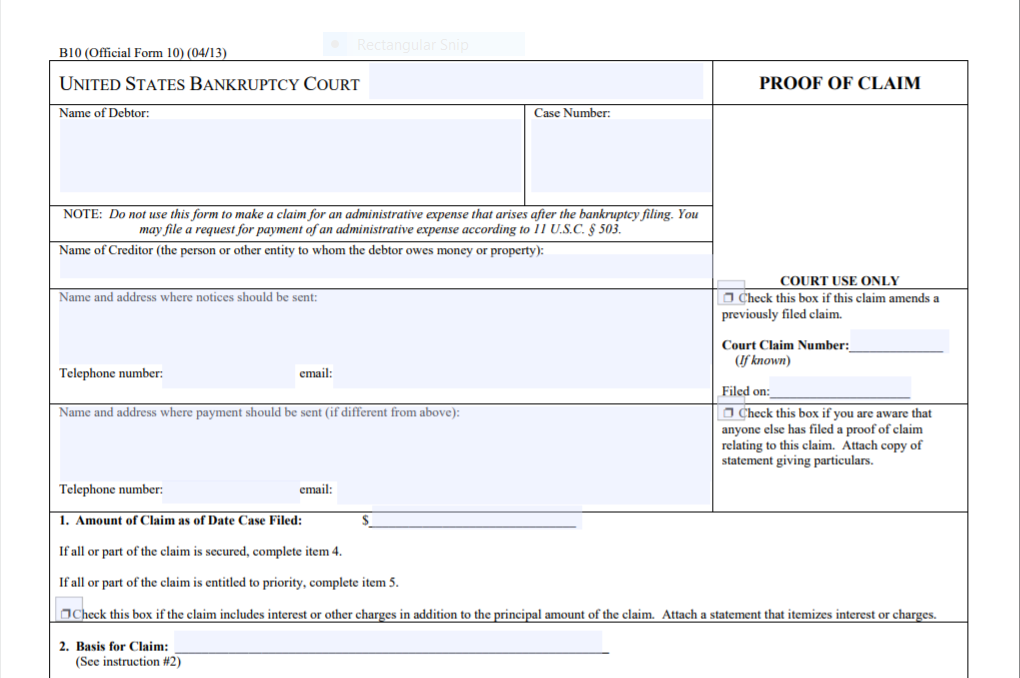

A Bankruptcy Trustee has contacted you demanding repayment of a preference – now what?

If a customer of your business has entered bankruptcy proceedings, and you have obtained payment from that organization recently, you may receive a letter demanding “repayment of a preference” or “repayment of an unfair preference.” This article aims to shed light on this issue and help you understand your options. Often when a business gets …Read more