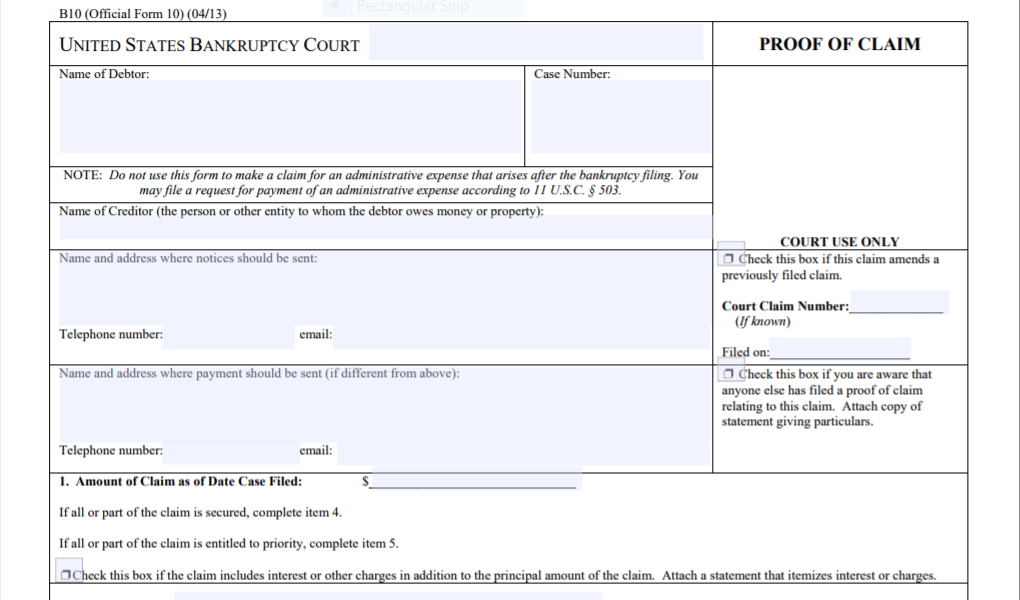

One of the first things you as a creditor should do when you receive notice that a customer has filed bankruptcy is to file a proof of claim. The Proof of Claim form (Official Form 10) often accompanies the notice of the commencement of the case, and can also be found at the Court’s website. Instructions for completing the form accompany the claim form. It needs to be completed in full, and supporting documents should be attached. The deadline for filing claims is set forth on the Notice of Commencement of the Case.

One of the first things you as a creditor should do when you receive notice that a customer has filed bankruptcy is to file a proof of claim. The Proof of Claim form (Official Form 10) often accompanies the notice of the commencement of the case, and can also be found at the Court’s website. Instructions for completing the form accompany the claim form. It needs to be completed in full, and supporting documents should be attached. The deadline for filing claims is set forth on the Notice of Commencement of the Case.

Claims should be filed timely or they can be forever time barred. Creditors who miss the filing deadline will have the burden of showing that the late filing should be allowed by showing that the deadline was missed through inadvertence or excusable neglect, and that there is no harm to the Debtor or the other creditors in allowing the case. The closer to the deadline the motion is filed, the more likely it is that the filing will be allowed, especially if the Debtor has not already prepared its plan. If a creditor is not listed and has not been given notice of the case, then the creditor will be allowed to file a late claim in order to share in any distribution.

Make sure you know whether you have a general unsecured claim, a priority claim or a secured claim and that you fill out the proof of claim correctly. You should probably have an attorney look at your records related to the debtor (any credit applications, invoices, etc.) to see if they contain language that might give you a basis for getting paid ahead of general unsecured creditors.