How do I File Bankruptcy for My Business

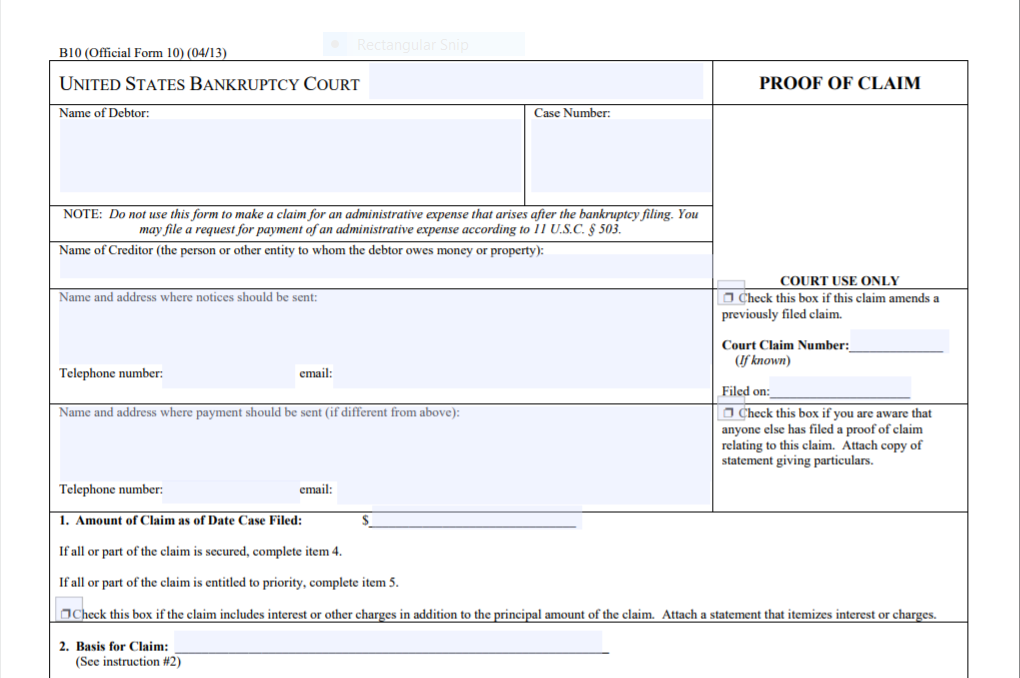

“I must file bankruptcy for my business.” That is not likely a part of your business plan but, if conditions bring you to that point, you must formulate a cohesive plan to manage safe passage through the bankruptcy minefield. Rule number one: If you are filing bankruptcy for a business entity you must use an …Read more