As a host of problems plague civilization – including the rise of authoritarian states, state sponsored electronic espionage, income inequality and climate change – people and markets are increasingly insisting that corporations generate positive social impact alongside profit. Investors have taken notice. The global impact investing market doubled from $114 billion in 2017 to $228 billion in 2018. That trend will almost certainly continue and possibly accelerate.

In the face of these trends, many entrepreneurs are starting for-profit companies committed to accomplishing a social mission. Many find the traditional corporate form does not adequately protect a company’s commitment to generating profits and positive impact over the long term. As a result, many companies are incorporating as Benefit (CA) or Public Benefit (DE) Corporations (“PBC” for short), a legal corporate form established in California in 2011 and in Delaware in 2013.

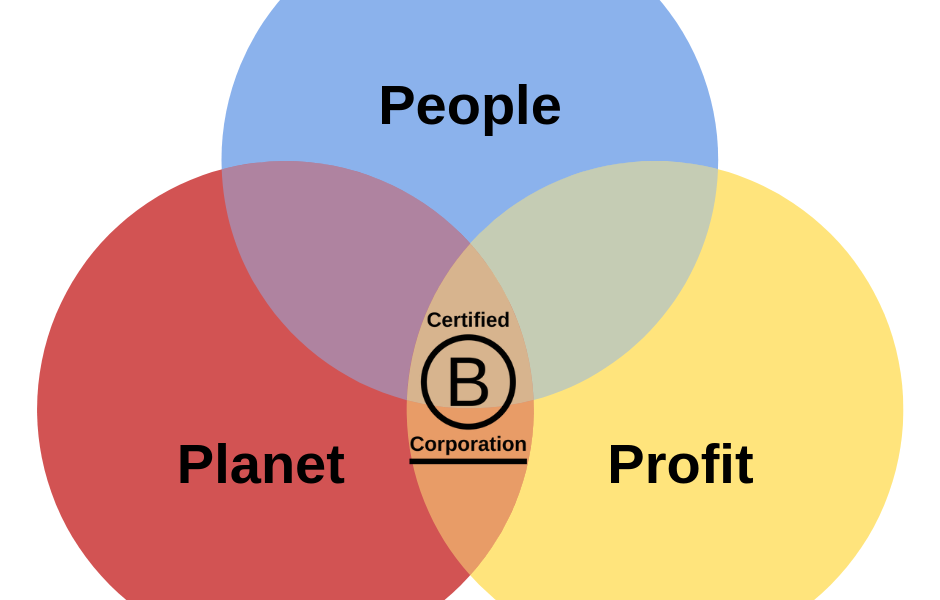

Those in charge of a PBC may make business decisions based not just on the economic interests of its shareholders – as required by a traditional c-corporation – but also based on (1) the best interests of those materially affected by its conduct (like employees, customers, communities and the environment), and (2) a specific public benefit identified in the company’s article or certificate of incorporation, like combating hunger, fighting homelessness, or increasing minority access to quality education.

Incorporating as a PBC can be advantageous for a mission-driven company. A PBC can help codify your strategy to focus on the long-term sustainability of the business and its social impact. It can help you tap into a skyrocketing market demand for products and services that are making a positive difference in the world. It can supercharge your talent recruitment process and employee loyalty. Indeed, more than 4,000 companies have incorporated as PBCs, including major brands like Patagonia and Kickstarter.

So why wouldn’t all companies want to structure or restructure as a PBC?

The most typical hesitation is the assumption that operating as a PBC will hinder a company’s ability to secure financing to start-up and grow. This concern is not unfounded. For emerging companies that are not yet able to generate significant revenues, investors expecting a return on their investment – that is after all why they’re called investors – can hold the keys to survival and growth of early stage companies. These investors are often averse to changing how they invest.

Notwithstanding this reluctance, many mainstream investors have decided to invest in PBCs, and not just as “one-off” investments, but rather as part of their overall investment strategy.

If you follow the general guidelines set forth below, you’ll significantly improve the chances that your PBC is well-positioned to successfully access this capital:

- Educate investors. Despite their recent rise in prominence, PBCs are still nascent legal entities. Early-stage investors might hesitate if they have always invested in traditional c-corporations. You must actively educate potential investors about the positive legal and commercial ramifications of the PBC form, and the particular mission of the PBC you aspire to create.

- Incorporate in Delaware. There is a strong preference among many early-stage investors to invest in corporations organized in Delaware. The rules are predictable, business-friendly, and explained in considerable detail by extensive case law. While 33 states have created their own form of the PBC, Delaware’s law seeks to provide the least restrictive version of the PBC. Make it easier for investors to say “yes” by incorporating your PBC in Delaware.

- Create a compelling benefit report. One of the chief differences between c-corporations and PBCs is the requirement that PBCs provide stockholders with a report that (1) details how the board intends to balance the best interests of the stockholders, its articulated public benefit, and other stakeholders, and (2) assesses the company’s success in meeting these objectives. It makes sense that a cash-strapped young company might turn this into a quick check-the-box exercise, but that would be a mistake. Instead, create a report that inspires, informs and persuades your current and future stockholders. It will set you apart.

- Run a tight ship. This is a universal point for all early-stage companies. It is particularly relevant for PBCs, which have a heightened incentive to demonstrate to investors that they’re as buttoned-up as any other for-profit company. You should prioritize well-organized corporate records. Put in place strong financial controls and company policies. Retain a diverse board and leadership team. Pursue transparent, open and active corporate governance. Don’t give investors any reasons to view your PBC as anything but a finely tuned business bent on improving the world and making money at the same time.

- Demonstrate that pursuing and achieving a public benefit is profitable business. This is by far the most important point. Skeptical investors might argue that achieving profits and positive impact are incompatible goals, and that companies need to choose one or the other. This is a tired argument used by certain industries to combat environmental and public health pursuits around the U.S. and the globe. Today, green energy, electric vehicles, and other environmentally progressive technologies are creating more jobs globally than many traditional legacy industries. Change investors’ minds by making a detailed case that your PBC will not just make the world a better place, but will also generate returns that meet or exceed the returns from a more typical venture-backed company.

If you can integrate these guidelines into your PBC’s fundraising strategy, you will be well on your way to raising transformative capital. Moreover, you will align with investors who have adopted your values and long-term strategy, a recipe that will help generate both profits and positive social impact for decades.