The purpose of granting equity to management, employees, consultants and advisors is to align the interests of the individuals central to the growth and success of your start-up company with the interests of investors. There are a number of ways to distribute start-up equity. The most common are stock options and restricted stock.

One of the most difficult decisions you, your co-founders and your board of directors will face when planning the growth of your start-up is determining how to distribute equity among yourselves, the management team, rank-and-file employees, consultants, and advisors. There is no one-size-fits-all model to determine who should receive equity and how much to allocate to each of them. The process requires you to evaluate a number of factors pertaining to your company and each category of equity recipient.

Equity Distribution Factors to Consider

At what stage of life is the company? C-level executives, middle managers, and rank-and-file employees who join the company before it receives any funding often receive larger equity stakes to compensate them for the risk they assume by working for an unproven company (as we know, most start-ups fail). Early-stage companies often can’t afford to pay salaries competitive with larger companies. To attract the best and brightest, they may have to make it up in equity.

What key roles within the company need to be filled? One company may reserve more equity for a strong CEO because it anticipates raising several rounds of funding and the CEO will have to pitch to those potential investors. Another company might put more equity into their employee incentive plan because it anticipates requiring a large work force that it must properly “incentivize” to retain and succeed. We recommend identifying the top four roles in your company, and how each might change over time.

Does the company anticipate raising capital via equity financing? After the initial capitalization, each subsequent financing will result in dilution of the initial owners’ interest in the company. Projecting a pro-forma cap table with anticipated future financings can help frame discussions among yourselves and your board about future ownership percentages and expectations. Outside of conversation among founders and the board, never ever discuss individual percentage ownership interests in the company. Simply grant individuals within categories of recipients the amount the board decides is appropriate for each category.

With respect to determining the amount of equity to issue to a recipient or group of recipients (e.g., engineers, salespersons, marketers, R&D staff, etc.), there are a number of factors to consider:

What forms of compensation is the company offering to employees? The amount of equity to grant an individual should be a piece of her total compensation package. If limiting the distribution of equity is important, consider increasing base salary or performance-based cash bonuses. If the company is unable to secure funds to do so, then consider issuing a greater equity stake as salary replacement.

What has the person’s contribution been to the company? Consider the individual’s past contribution, the amount of time and money spent on the company, the opportunity cost, and her contribution to the original ideas underlying the vision and business plan for the company.

What is the Person’s specific area of expertise, work experience and role in the company? Determine the individual’s expertise and the importance of her role to the growth of the company. Is the individual in the top four list you prepared earlier? Will the importance of her role grow or shrink over time? For very early-stage companies there are numerous resources, some of which are identified below, that will help you determine equity splits among founders, C-level executives, managers and employees based on a list of specific contributions and roles. Among the many questions you should ask are: who is well-connected in the industry we’re targeting? who is a product leader in this industry? and who will be the person pitching investors?

A start-up may also want to consider setting aside some equity for formal or informal advisors who can be instrumental resources, depending upon their experience, network, and industry influence.

Equity Compensation Trends in the Tech Industry

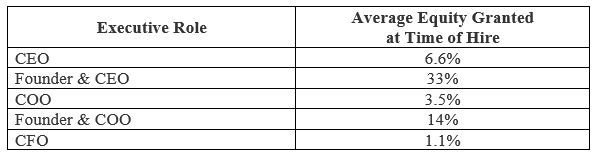

Recent compensation data assembled by CompStudy provides some interesting, if not definitive, insights into equity compensation among private technology and biotechnology companies nationwide.

Data from 2017 show a slight increase in equity compensation for Chief Executive Officers and Chief Operating Officers of private tech companies.

CompStudy’s data also shows that a majority of independent board members receives equity compensation of 0.25% or less, and the vast majority receives equity compensation of 0.5% or less. Despite this, in 2017 roughly 30% of private tech companies granted board members who also serve as the chairperson 2% or greater equity. These data differ from year-to-year and provide only trends. For more information, check out the resources identified below.

Resources

Below are a few online tools that may help you and your board determine how to distribute equity in your start-up.